Interest rates got you down? Let me share Sarah and Mike's real story, because I know it sounds tough out there. Just a few months ago, they were in the same boat, feeling overwhelmed by high interest rates.

Here's how they managed to turn things around:

First, they discovered Shared Equity Agreements. By partnering with an investor, they reduced their loan amount and monthly payments without adding to their debt. It was a game-changer.

Next, they considered co-buying. Sarah's brother chipped in, and together they were able to split the costs, making the dream of homeownership a reality.

They also looked into Live-In Renovation. They bought a fixer-upper, moved in, and tackled renovations bit by bit. This allowed them to increase the property value and set up a better refinancing rate down the line.

For some added flexibility, they explored a Lease-to-Own option. This gave them time to save for a down payment and improve their credit score while locking in a future purchase price.

Sarah and Mike also took advantage of Government Programs, securing an FHA loan with lower interest rates and down payment requirements.

Down Payment Assistance programs were another lifesaver, providing grants to help with their down payment and closing costs.

When traditional mortgages didn't fit, they turned to Seller Financing. The seller offered more flexible terms and a lower interest rate, making the process a bit smoother.

To further ease the financial burden, they decided to try House Hacking. They bought a multi-unit property, lived in one unit, and rented out the others. The rental income helped cover their mortgage payments.

They didn't overlook First-Time Homebuyer Programs either, which provided financial assistance and educational resources to navigate the process.

Additionally, they benefited from thorough financial planning and guidance from a trusted mortgage advisor. The advisor helped them understand their financial landscape and identify the best strategies for their specific situation. This personalized advice was crucial in making informed decisions and staying confident throughout the home buying process.

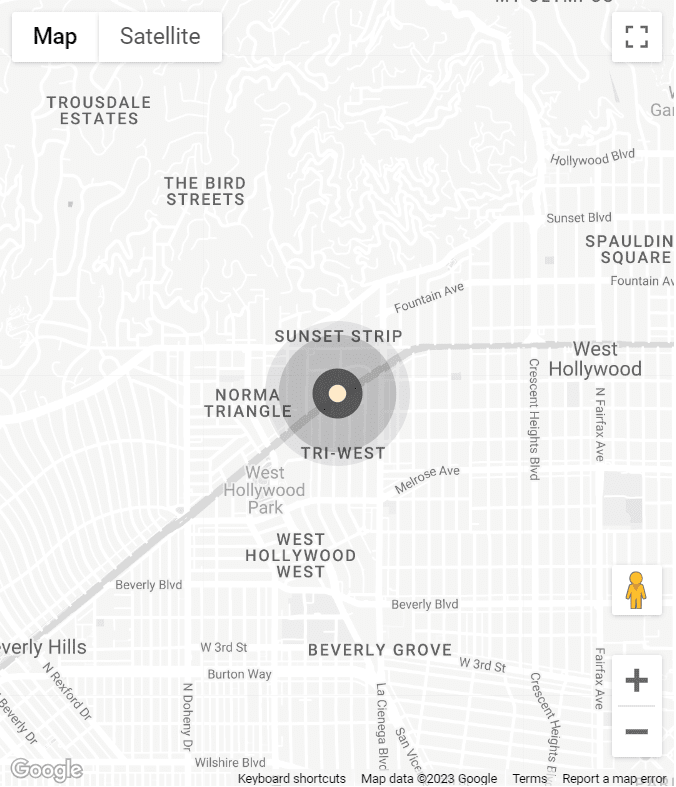

Understanding local market trends was crucial to their success, greatly aided by insights from their knowledgeable real estate agent (Hello 👋). By keeping an eye on market dynamics, they were able to time their purchase to get the best possible deal. They attended local homebuyer workshops and seminars, gaining insights into market conditions and networking with professionals who provided them with valuable tips and opportunities.

Moreover, they used technology to their advantage by using online tools to compare mortgage rates and terms from various lenders. This ensured they got the most competitive rates and terms available, which significantly lowered their overall costs.

Sarah and Mike's dedication to understanding and utilizing available resources shows just how diverse the options for overcoming high interest rates can be. From government assistance to innovative financing methods, their journey is a testament to the fact that the challenges posed by the current economic climate can be met with perseverance and creativity.

Their experience illustrates that homeownership is still attainable despite financial hurdles. It’s about finding the right mix of resources, timing, and strategies tailored to your unique situation. If you’re feeling daunted by high interest rates or the complexity of the homebuying process, remember Sarah and Mike’s story and the many paths you can take towards owning your dream home. Ready to start your journey? Let’s chat and explore your options to navigate this dynamic market.

Daniele Gordon, P.A.

Associate Broker

Coldwell Banker Realty

954.589.7787

Connecting Buyers - Sellers - Investors